CMS has advised Zagrebacka Banka on the refinancing of Mlinar Group’s existing debt in connection with Bosquar Invest’s acquisition of a 67% indirect stake in the company. Savoric & Partners and A&O Shearman reportedly advised Mlinar and Bosquar Invest.

CMS Advises AB Investment Group on Albena Solar PV and BESS Project Licensing

CMS has advised AB Investment Group on the licensing process before the Bulgarian Energy and Water Regulatory Commission for its 27-megawatt PV and 24-megawatt-hour BESS Albena Solar Project.

Bulgaria’s Electricity System Expects Major Investments for 400kV and 110kV Networks Over Next Decade

Bulgarian’s electricity transmission system operator (ESO EAD) has published its ten-year network development plan (TYNDP), subject to final approval by the Bulgarian Energy and Water Regulatory Commission (EWRC), which has made the 400kV network the backbone of the electricity transmission network in Bulgaria, whose geographical location suggests there will be great commercial interest in using its transmission network for electricity transit.

Schoenherr, CMS, and RRH Legal Sarajevo Advise on Sale of 80% Stake in Baupartner to Molins–Titan JV

Moravcevic Vojnovic and Partners in cooperation with Schoenherr has advised the shareholders of Baupartner on the sale of an 80% equity stake to a joint acquisition vehicle formed by Molins and Titan. CMS and RRH Legal Sarajevo advised Molins and Titan.

CMS Advises ING Bank on Pre-Export Finance Facility for Ukrainian Agricultural Group

CMS, working with Cyprus-based Michael Damianos & Co, has advised ING Bank on a pre-export finance facility provided to a Ukrainian agricultural group.

RTPR and A&O Shearman Advise OX2 on Sale of Onshore Wind Project in Romania

RTPR and Allen Overy Shearman Sterling have advised OX2 on the sale of the 96-megawatt Ansthall onshore wind farm in Galati County, Romania, to Helleniq Renewables. CMS reportedly advised the buyers.

Cobalt and Sorainen Advise on EUR 85 Million Financing for Sunly’s Solar Projects in Latvia

Cobalt, working alongside Clifford Chance, has advised the European Investment Bank, the European Bank for Reconstruction and Development, and SEB on a EUR 85 million financing package for Sunly. Sorainen, working with CMS, advised Sunly.

Dentons, Schoenherr, CMS, Turcan Cazac, and Norton Rose Fulbright Advise on Purcari Wineries's RON 604 Million Public Takeover Bid by Maspex

Dentons has advised the Board of Directors of Purcari Wineries on the RON 604 million public takeover bid launched by Maspex Romania. Schoenherr advised the founders of the winery. CMS, working with Turcan Cazac and Georgiades & Pelides, advised Maspex. Norton Rose Fulbright advised PKO Bank Polski on a loan facility to Maspex Romania to support the acquisition.

White & Case Advises Montagu on Acquisition of IAI Group

White & Case has advised Montagu on its acquisition of IAI Group from MCI Capital ASI and founders Pawel Fornalski and Sebastian Mulinski. Dubinski Jelenski Masiarz reportedly advised the sellers.

CMS Advises Bonafarm Group on Acquisition of FrieslandCampina Romania

CMS has advised Bonafarm Group on its acquisition of a 97.57% stake in FrieslandCampina Romania from Royal FrieslandCampina.

White & Case and Bondoc si Asociatii Advise Lender Syndicate on EUR 331 Million Financing of Second Phase of VIFOR Wind Farm in Romania

White & Case and Bondoc si Asociatii have advised a syndicate of eight commercial banks and international financial institutions on the EUR 331 million financing of the second phase of the VIFOR wind farm project in Romania, currently being developed by Rezolv Energy, an Actis platform.

ODI Law and CMS Advise on GrECo's Acquisition of SIPOS in Slovenia

ODI Law has advised GrECo on its acquisition of SIPOS Posredovanje Zavarovanj. CMS advised the sellers, Jurij and Majda Mravlja.

CMS Advises UniCredit Group on EUR 550 Million Fortenova Grupa Refinancing

CMS, working with Clifford Chance, has advised UniCredit Group and Zagrebacka Banka on the EUR 550 million debt refinancing granted to Fortenova Grupa. King & Spalding reportedly advised Fortenova Grupa.

CMS Advises Callstack Shareholders on Investment by Viking Global Investors

CMS has advised Callstack shareholders Anna Lankauf, Mike Grabowski, Piotr Karwatka, and Tomasz Karwatka on an investment by Viking Global Investors.

CMS and DGKV Advise on Renalfa IPP's EUR 1.2 Billion Investment Program and EUR 315 Million EBRD-Led Financing

CMS, working with Ashurst, has advised Renalfa IPP on the development of its EUR 1.2 billion investment program in photovoltaic, battery electricity storage systems, and wind projects across Bulgaria, Hungary, North Macedonia, and Romania. The firm also advised on securing a EUR 315 million club loan facility led by the EBRD and backed by an InvestEU loss guarantee. DGKV, and reportedly A&O Sherman and PHH, advised the lenders.

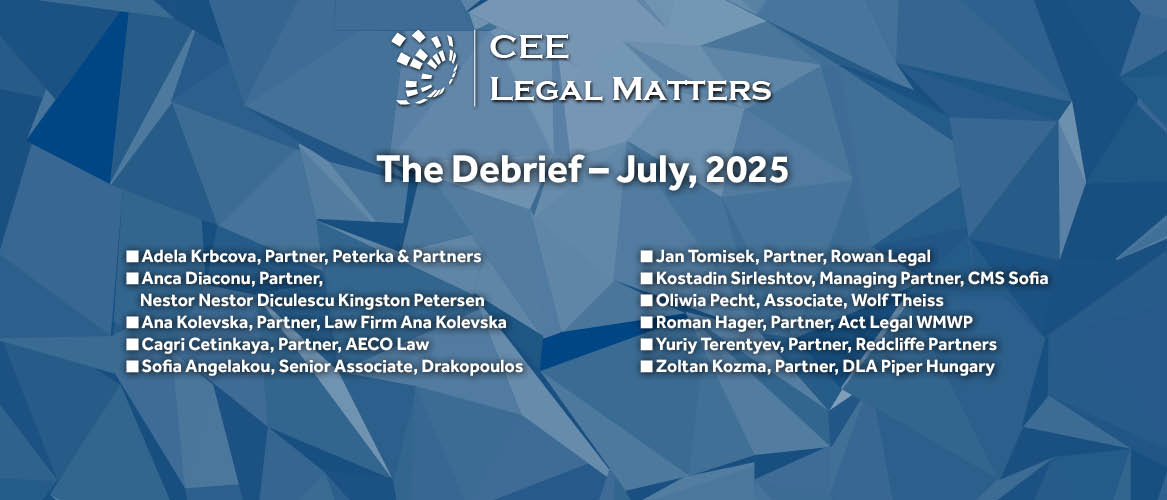

The Debrief: July 2025

In The Debrief, our Practice Leaders across CEE share updates on recent and upcoming legislation, consider the impact of recent court decisions, showcase landmark projects, and keep our readers apprised of the latest developments impacting their respective practice areas.

Harrisons Advises EBRD on EUR 13.4 Million Dual Loan Package for Inn-Flex’s Expansion in Serbia

Harrisons has advised the European Bank for Reconstruction and Development on two loans granted in connection with Inn-Flex’s expansion into Serbia.

CMS Advises Central European Petroleum on Wolin East Project

CMS has advised Central European Petroleum on the development of the Wolin East project, following CEP’s announcement of a discovery of oil and gas reserves in the Wolin East 1 well, located on Polish territory in the Baltic Sea.