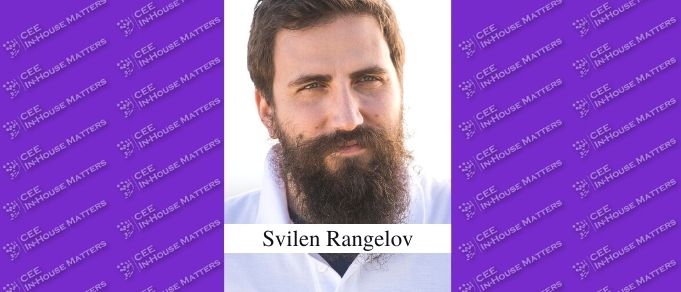

On January 18, 2022, CEE Legal Matters reported that Tsvetkova Bebov & Partners had advised Dronamics Capital on its IPO and listing on the Beam market of the Bulgarian Stock Exchange. CEE In-House Matters spoke with Svilen Rangelov, Co-Founder and CEO at Dronamics Capital to learn more about the matter.

CEEIHM: To start, tell us a bit about Dronamics Global Limited and Dronamics Capital.

Rangelov: Dronamics Global is the global HQ of the Dronamics group that unites all of our activities and companies – from the R&D and manufacturing in Bulgaria to our Airline entities that are our future operational units. Dronamics Capital is a Special Purpose Vehicle (SPV) founded with the sole purpose to raise EUR 3 million (the limit in Bulgaria) on the Bulgarian Stock Exchange's SME Market (called "BEAM") and use the proceeds to invest in a SAFE note into Dronamics Global. The SAFE note (Simple Agreement for Future Equity) is an increasingly popular convertible financing instrument due to its simplicity and balance, and thousands of startups worldwide use it – we have used it exclusively since 2018. As for Dronamics Capital – 90% of the EUR 3 million raised during the IPO on BEAM was invested in Dronamics Global's SAFE note, with the remaining 10% kept in reserve for the ongoing maintenance of Dronamics Capital.

The key advantage however is that when the time comes for us to list our UK-headquartered parent company on e.g. NYSE or NASDAQ, the retail investors in Dronamics Capital have the option to trade their shares in Dronamics Capital for shares in Dronamics Global and essentially participate in the IPO of a high-growth technology company on a global stock exchange.

CEEIHM: Congratulations on the IPO. What is next for the company now that this step is concluded?

Rangelov: The IPO has allowed us to offer an early opportunity to individual investors to join the company just before we hit our key milestones this year – our upcoming authorization and first commercial flights.

The funds raised through the IPO are just a fraction of what we raised over the past several months, but it was important for us to do it because the same way we aim to democratize air cargo, we wanted to democratize access to high-growth tech investment opportunities.

What we've witnessed is that with the influx of capital into VC as an asset class, companies stay private a lot longer, and ordinary retail investors don't get to invest in tomorrow's winners at the early stages and so all that value-generation is kept away from the general public. Amazon did an IPO at a USD 400 million valuation, last year's hot IPOs crossed USD 50 billion valuations, or 100x of value growth that was not accessible to retail investors or pension funds.

On a company level, we're now focused on scaling our team and financing further the development of the next production units of the Black Swan aircraft, so that we get into a prime position to capture the outstanding customer demand that we are currently seeing with global logistics companies like DHL and Hellmann Logistics on board.

CEEIHM: What part of the process did you find most challenging?

Rangelov: Doing the first-of-its-kind listing of an SPV on the fairly new BEAM market required us to start from scratch with all the documentation and procedures that need to be undertaken by both entities and ensure the needed transparency and clear processes. Striking the right balance between protecting the SPV's purpose from hostile takeovers via a golden share, and allowing maximum shareholder rights, was a key focus of our work. The SPV has an independent board with three outstanding experts in law, finance, and technology, who are very respected in their fields and are making sure corporate governance is strictly upheld.

The other key focus was on exit planning and making sure that shareholders of the SPV have the right to exchange their shares for the shares of Dronamics Global held by the SPV in the event of an exit, and fully realize the value of the underlying asset's growth.

CEEIHM: What was Tsvetkova Bebov & Partners' mandate on the IPO?

Rangelov: Our listing was a first of its kind in Bulgaria and perhaps the world for essentially listing a SAFE note investment on a stock exchange. TBP worked with us and our brokers and advisors at Karoll and turned a crazy idea into a pioneering framework that we hope can be utilized by other start-ups in a similar position.

CEEIHM: And why did you pick them as your advisors?

Rangelov: We had previously collaborated with the team at TBP and they have always shown an intensely solution-oriented approach to supporting our vision. They are also by far the most experienced capital markets law firm in Bulgaria and they have a great understanding of the mechanisms of a listing and how to make it successful. We chose the team at TBP because they are by far the best capital markets team in Bulgaria and whenever you want to venture on a pioneering journey, you want the best team alongside you. And best of all, they did it in record time and with record results.

The IPO was 4.5 times oversubscribed with almost 1,000 shareholders taking part (for reference - to be included in the main index on the main market of the Bulgarian Stock Exchange you need only 750 shareholders), confirming our thesis that there is tremendous demand for quality investment opportunities in the high-growth technology sector.

Originally reported by CEE In-House Matters.