The insurance arbitration system is an alternative dispute resolution mechanism aimed at resolving disputes arising from insurance contracts more quickly and efficiently, without resorting to the courts.

Ineffective Judgment in Turkish Law and Its Differences from Apparent Judgment

The ultimate aim of judicial proceedings is to resolve disputes substantively and eliminate legal uncertainty between the parties. The most critical phase of this process is the “judgment”, which constitutes the final decision rendered by the courts. However, although a judgment is a decision that concludes the trial, in some cases, it may not produce legal effects, meaning it is considered “ineffective”.

Correction & Additional Decision in ICC Arbitration Law

The final and binding nature of arbitral awards provides legal predictability to the parties while also allowing for the possibility of material errors or omissions in the arbitral decisions.

Recent Amendments to Decree No. 32 under Turkish Law

The Decision Amending the Decree No. 32 on the Protection of the Value of Turkish Currency (the “Decision”), published in the Official Gazette on March 15, 2025, has introduced significant changes to the financial regulations in Turkey. In this context, let us examine the newly introduced regulations and the updated provisions together.

Exclusive Evidentiary Contracts

An exclusive evidentiary contract is a type of agreement in which the parties undertake to accept the assessment of a person or panel appointed to evaluate certain technical or expert matters related to a specific dispute. This agreement, particularly used in areas requiring technical expertise, functions as an evidentiary contract and carries binding consequences for the parties.

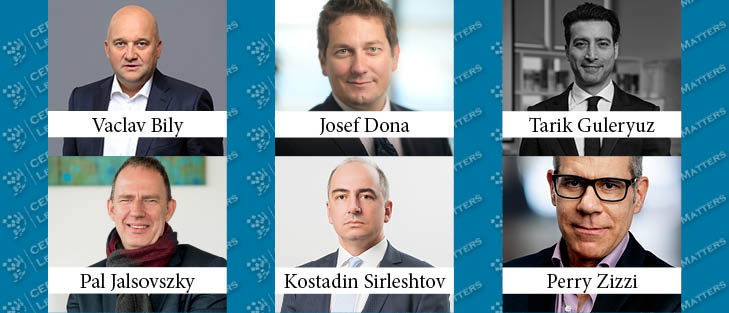

The Corner Office: Legal Tech (to the Rescue)

In The Corner Office, we ask Managing Partners at law firms across Central and Eastern Europe about their backgrounds, strategies, and responsibilities. With industry-specific software emerging left and right, the legal industry was not left behind. To explore some of the trends in this regard, we asked: What are some of the specific legal tech platforms you use?

The Slow Roast of Summer Months

Summer is traditionally a slower period for many, including the legal sector, but, if used right, the time can pay dividends for law firms.

Turkiye: Green Energy Infrastructure and PPP Projects

Public-private partnerships (PPPs) are cooperation agreements between public and private sectors for providing public services traditionally provided by the state and funded by taxpayers. These partnerships involve sharing investments, risks, liabilities, and revenue between the parties, ensuring public welfare by addressing economic challenges in essential sectors. PPPs offer an alternative approach to traditional state-financed projects, allowing faster and more efficient construction of large-scale projects.

A Brief Assessment of Turkiye’s International Direct Investment Strategy for the Period 2024-2028

On July 29, 2024, in the Official Gazette No. 32616, Türkiye’s International Direct Investment (‘‘IDI’’) Strategy for the period 2024-2028 was announced to the public. This strategy aims to move Turkey to a stronger position on the global investment map by setting Turkey’s goals and priorities in the field of international direct investments and targets to create a comprehensive support mechanism to reduce the obstacles faced by investors in Turkey and to provide solutions to their needs.

The Debrief: June, 2024

In The Debrief, our Practice Leaders across CEE share updates on recent and upcoming legislation, consider the impact of recent court decisions, showcase landmark projects, and keep our readers apprised of the latest developments impacting their respective practice areas.

Oil & Gas in CEE: A CEE Legal Matters Round Table

On February 29, 2024, energy experts from Bulgaria, Croatia, Moldova, Turkiye, and Ukraine sat down for a virtual round table moderated by CEE Legal Matters Managing Editor Radu Cotarcea to discuss the key developments in the field of oil & gas over the past few years.

Turkiye: New Amendments Will Allow for the Construction of Electricity Generation Facilities on Water Bodies

With the introduction of a recent omnibus legislative proposition presented to the Grand National Assembly on January 29, 2024, a significant legislative shift will occur in Turkiye’s renewable energy production sector.

The Corner Office: Skills of Tomorrow

In The Corner Office, we ask Managing Partners at law firms across Central and Eastern Europe about their backgrounds, strategies, and responsibilities. Given the dynamic and ever-evolving nature of the legal profession, we asked: What is the one critical skill that you’re investing time and energy in to develop within your team, and why?

Turkiye: The “Airbnb Law” – New Regulation on Short-Term Leases in Turkey

Ever since Booking.com’s activities had been suspended in Turkey by a court decision upon “unfair competition” claims raised by the Association of Turkish Travel Agencies (TURSAB), new regulations were anticipated in the short-term lease sector dominated by Airbnb, as unregistered and untaxed rental income obtained from short-term rentals has been a matter of discussion for a long time.

The Debrief: March 2024

In The Debrief, our Practice Leaders across CEE share updates on recent and upcoming legislation, consider the impact of recent court decisions, showcase landmark projects, and keep our readers apprised of the latest developments impacting their respective practice areas.

The Corner Office: 2024 Wishes and Perils

In The Corner Office, we ask Managing Partners at law firms across Central and Eastern Europe about their backgrounds, strategies, and responsibilities. As we bid farewell to 2023, this time around we turn our attention forward: What is your one main wish for 2024 and what do you see as the biggest potential risk?

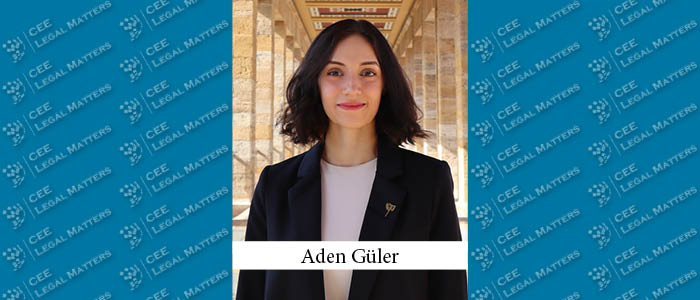

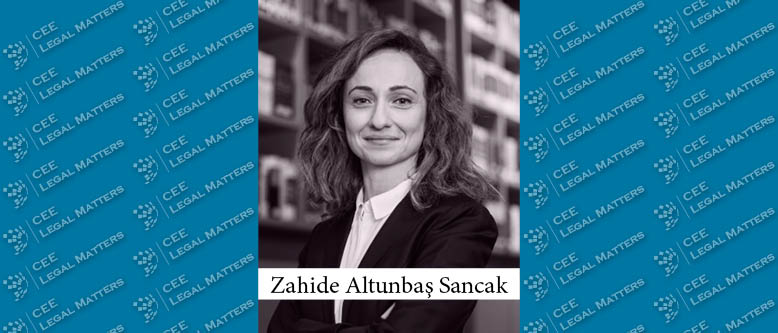

A Gauge of Confidence in Turkiye: A Buzz Interview with Zahide Altunbas Sancak of Guleryuz Partners

Turkiye always has its ups and downs, according to Guleryuz Partners Partner Zahide Altunbas Sancak, who points to the coming local elections and their role as a confidence check, while also making her own bets that include technology, digital banking, and energy.

World Economic Forum Establishes AI Governance Alliance to Ensure Safety in the Use of Artificial Intelligence

The World Economic Forum established the AI Governance Alliance, bringing together leaders from diverse sectors such as industry, government, academia and civil society to support the responsible global development and use of transparent and inclusive AI systems.