In its recent decision of 19 February 2025, the Supreme Court of Hungary (‘Curia’) overturned the second-degree verdict that held fraud victims solely liable and ruled that financial institutions cannot automatically reject compensation claims. This landmark decision might open the doors for customers to claims against their banks in similar cases.

Montenegro: Regulation of Business Operations Related to Crypto Assets Through Amendments to the Law on Prevention of Money Laundering and Terrorist Financing

The Law on Amendments to the Law on Prevention of Money Laundering and Terrorist Financing ("Law") has been adopted, and a decree on its promulgation has been issued. The Law was published in the “Official Gazette of Montenegro” on 12th March 2025, and it enters into force on 20th March 2025.

North Macedonia: Commission for Protection of the Competition of North Macedonia Strengthens Oversight of Food Supply Chain and Food Retail Sector

The Commission for Protection of the Competition of North Macedonia (CPC) has significantly intensified its enforcement activities in the food retail sector, signalling a stricter regulatory approach toward potential anti-competitive behaviour.

List of Companies Eligible for Diia City Residency Expanded

On 21 February 2025, the Cabinet of Ministers of Ukraine, by Resolution “On Amendments to the List of Activities Encouraged by the Creation of Diia City Legal Regime” No. 204 (the “Resolution”), expanded the list of eligible activities for Diia City residency.

The Art of the Rare Earth Deal: Is the Devil in the Details?

Mineral rights deals may seem like a big win, but they are not without risk. Considering the wider implications of mineral rights deals.

Hungary: Understanding the EU AI Act in Practice

10+1 Questions and Answers for Hungarian Companies.

Reverse Transfer of a Business Share in a Slovak Limited Liability Company

The transfer of a business share is a routine process in corporate transactions. A share purchase agreement (SPA) must be in writing with notarized signatures. The transfer becomes effective upon the company's receipt of the SPA unless a later date is specified. However, if required by law or the memorandum of association (MoA), it cannot take effect before the general meeting grants approval. Each transfer must also be registered in the Slovak Commercial Register (“Commercial Register”). In practice, complications may arise when one party withdraws from an SPA.

The Turkish Competition Authority Decided That There Is No Procedural Benefit in Initiating Commitment Negotiations

Pursuant to the Competition Board’s (“Board”) decision dated 15.12.2022 and numbered 22-55/850-M, an investigation was initiated to determine whether Nestle Türkiye Gıda Sanayi AŞ (“Nestle”) infringed Article 4 of the Law No. 4054 on the Protection of Competition (“Competition Law”) by (i) setting the resale price of its distributors and (ii) imposing regional and customer restrictions on them.

The Constitutional Court of the Republic of North Macedonia Votes to Annul Solidarity Tax Law

On 5 February 2025, the Constitutional Court of the Republic of North Macedonia (“Court”) annulled the Solidarity Tax Law (“Law”), ruling that it violated several key constitutional principles.

Obligations of Traders in Advertising Food Products

The Assembly of the Serbian Chamber of Commerce (“SCoC”) recently adopted the Code of Practice for Advertising by Wholesale and Retail Traders of Food Products (“Code”), which entered into force on January 1, 2025.

Updated 2025 Arm's Length Interest Rates Published

The Ministry of Finance has adopted the Rulebook on interest rates considered to be in line with the "arm’s length" principle for 2025. The Rulebook was published in the Official Gazette on February 28 and will enter into force on March 8.

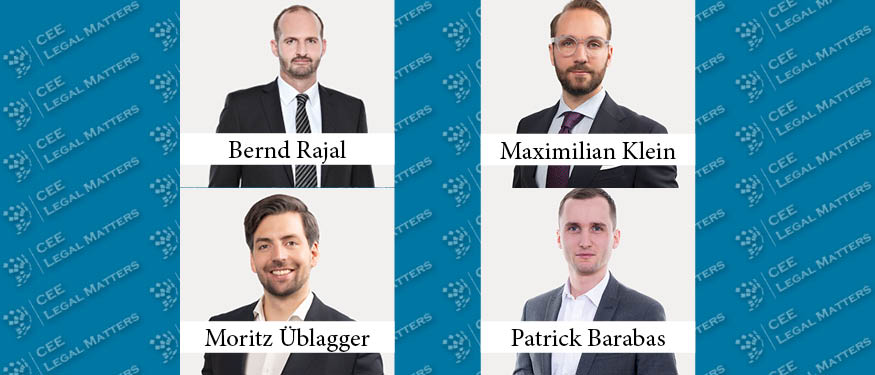

Shaping the Future of Energy: Legal Implications of Austria's New Government Programme

The government programme of the three-party coalition for the years 2025-2029 has been established. In the field of energy law, long-awaited legislation such as the Electricity Industry Act (ElWG), the Renewable Gas Act (EGG) and the Renewable Expansion Acceleration Act (EABG) are set to be enacted.

How to Employ Employees Abroad?

Connecting a holiday in Tenerife with remote work? Sending an employee to China for three months? While ten years ago, these questions were considered unique, today, international mobility has become an everyday part of employment relationships.

EU's Clean Industrial Deal: Merging Climate Goals with Competitiveness

On 26 February 2025, the European Commission (EC) unveiled the Clean Industrial Deal (CID), a comprehensive strategy aimed at enhancing the competitiveness and resilience of European industry while accelerating decarbonisation. In response to high energy costs and increasing global competition, the CID positions decarbonisation as a key driver of growth, ensuring that Europe remains a hub for industrial innovation and production. By reducing bureaucratic hurdles, promoting clean technology and securing financing for the green transition, the initiative strengthens critical sectors such as energy-intensive industries and clean tech.

(Un)Equal Pay

The right to equal pay for the same work or work of equal value is one of the fundamental rights of employees, protected by both domestic legislation and international standards. In Montenegro, this right is regulated by the Labor Law, while judicial practice contributes to its interpretation and application. Furthermore, the case law of the Court of Justice of the European Union plays a significant role in shaping the legal framework, providing guidelines for the protection against discrimination in terms of wage equality.

Serbia Renewable Energy Auctions Surpass Expectations

At the end of 2024, the Ministry of Mining and Energy announced the second auction for wind and solar power plants. The deadline for applying for participation in the auctions is 05.02.2025. year. After consideration of all applications and bids, the entire capacity offered at the auctions for wind farms (300 MW) and for solar power plants (124.8 MW) was successfully allocated.

Hungary to Open Doors for New Power Plant Projects as New Capacity Allocation System Takes Shape

Let's start with the fundamentals: Hungary will need significant additional power plant and battery capacities, and it will need them soon. This necessity persists despite the gross amount of solar power capacity reaching 7.5 GW by the end of 2024, a target initially set for the 2030s. The drive for electrification, the goal to reduce energy imports, the high average age of the existing generator portfolio and the previous focus on solar energy necessitate at least 10 GW of new generation capacities, with a preference for baseload generation and/or storage solutions. The state-owned incumbent MVM is already developing 3x500 MW new combined cycle gas turbine (CCGT) installations and 2x1000 MW new nuclear blocks, but significant private investment is still required.

Romania Looks to Boost PPAs Following RED III Transposition

The target for renewable energy consumption in Europe is to reach at least 42.5 percent by 2030 for all sectors, under Directive (EU) 2023/2413 of the European Parliament and of the Council. Known as RED III, it encourages the conclusion of power purchase agreements (PPAs) by requiring member states to adopt various measures.