In a recent update to the VAT Act in Slovenia, notable amendments have been introduced, particularly focusing on services in the public interest. Article 42(1)(5) of the VAT Act has changed, emphasizing VAT exemptions exclusively for services provided within activities deemed in the public interest.

Austria's Mariella Kapoun and Georg Gutfleisch and Slovenia's Amela Zrt and Ivan Kranjec Make Partner at CMS

Mariella Kapoun and Georg Gutfleisch have become Partners at CMS in Austria, while Amela Zrt and Ivan Kranjec have become Partners at CMS in Slovenia, as part of the firm's latest promotion round.

Legislative Provisions Related to the State of Exceptional Situation

By Decision No. 361 dated 24 November 2023, the Parliament decided to extend the emergency state on the entire territory of the Republic of Moldova for 30 days, starting on 1 December 2023.

Jalsovszky Head of Tax Advisory Akos Barati Makes Partner

Head of Tax Advisory and Wealth Management Akos Barati has been promoted to a Partner position with Jalsovszky in Budapest.

Valeriu Cernei Makes Partner at Gladei & Partners

Former Senior Associate Valeriu Cernei has been promoted to a Partner position with Gladei & Partners in Chisinau.

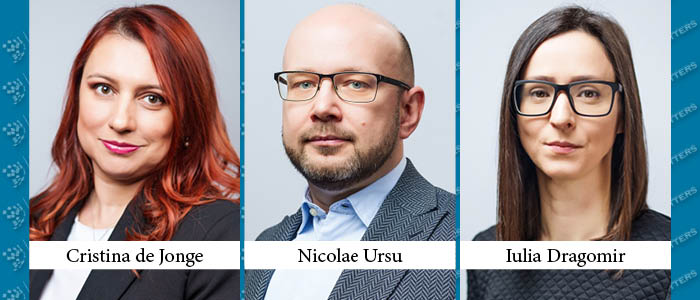

Cristina de Jonge, Nicolae Ursu, and Iulia Dragomir Make Partner at BPV Grigorescu Stefanica

Former Managing Associates Cristina de Jonge, Nicolae Ursu, and Iulia Dragomir have been promoted to Equity Partners at BPV Grigorescu Stefanica.

E-VAT System Goes Online in Hungary

The digitalisation of the Hungarian tax system has reached another important milestone: after lengthy preparatory work (and a few setbacks), the e-VAT system was launched on 1 January 2024, on a voluntary basis, for now.