Avellum has advised Interpipe Holdings on a USD 300 million issue of 8.375% guaranteed notes due 2026. Sayenko Kharenko advised the joint lead managers and bookrunners on the deal.

The notes were admitted to listing on the Luxembourg Stock Exchange. Goldman Sachs International and J.P. Morgan were joint lead managers and bookrunners of the Eurobond issue.

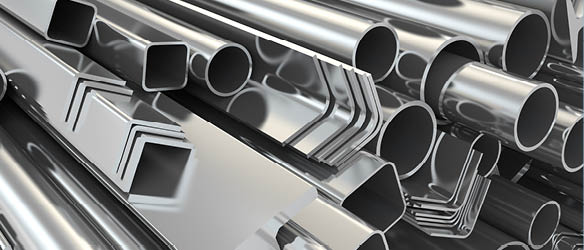

According to Avellum, Interpipe is a producer of steel pipes and railway wheels products, based in Ukraine. The company’s products are shipped to over 80 countries worldwide via a network of sales offices located in the key markets of Ukraine, Europe, North America, and the Middle East.

Avellum’s team was led by Senior Partner Glib Bondar with support from Senior Associate Anastasiya Voronova and Associates Oleg Krainskyi, Anna Mykhalova, and Mariana Veremchuk.

Sayenko Kharenko's team included Partner Nazar Chernyavsky, Counsel Iryna Bakina, Associates Denis Nakonechnyi, Oles Trachuk, Vladyslava Mitsai, Sofiia-Mariia Kuzminska, and Junior Associate Oleksandr Motin.